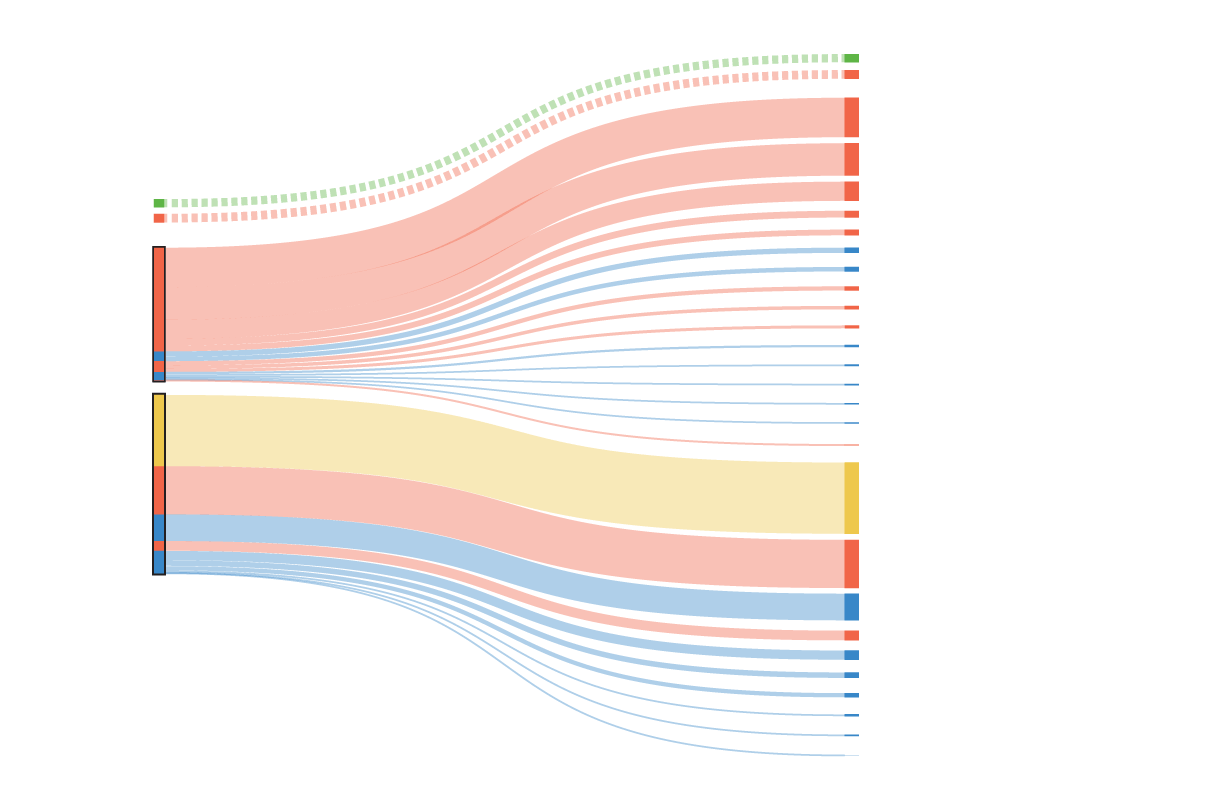

Sound Transit 3 (Nov. 8) $120

Seattle Housing Levy (Aug. 2) $122

School maintenance and operation $577.22

School construction $473.48

Move Seattle transportation $279.23

Proposed

Families/education $98.18

Seattle general obligation bonds $85.23

Parks and open space $76.77

Best Start for Kids $67.20

Taxes voters have approved themselves

$1,944.03

Seattle Housing Levy (expires 2016) $60.88

Library services $51.48

Preschool funding $42.81

Emergency radio communications $33.60

Children/Family Justice Center $26.92

Fingerprint ID system $22.87

Human services/veterans $20.25

County bonds $19.10

Taxes approved by state, local legislative bodies. No direct vote by public

$2,608.97

Campaign financing $8.81

State schools $1,041.11

Seattle general fund $704.40

County government $390.66

Seattle Park District $140.49

Emergency Medical Service $135.52

Port $81.37

County flood zone $62.30

County transportation $30.46

County conservation $21.33

County ferry district $1.33